Would you like to calculate the return on investment of your next marketing campaign? It’s not as difficult as it might seem. All you have to know are a few basic calculations.

In this blog post, we’ll discuss the language of finance — these are the terms your CFO and CEO use to discuss the success (or lake of success) of the business.

We’ll also show you how to use Lifetime Value (LTV) to figure out if your campaign is actually generating the kind of profit you need. And we’ll look into Cost Per Acquisition (CPA), another important term you should be familiar with.

Check out the video below. Or, read the transcript below the video. Either way, at the end, you’ll know how to calculate the ROI of your next marketing campaign.

Transcript:

Hey, did you know that most people can’t calculate the return on investment of their marketing campaigns?

It’s true. They get in with their CEO or their CFO and they say, “Hey, show us the money. Did that campaign generate revenue for us? Did we make a profit on that campaign and they can’t do it?”

Now here’s the cool news. It’s not that complex. In fact, if you follow along with two things, I’m going to teach or you’ll be able to talk to the CFO and the CEO and convince them of the value of your campaigns.

The first thing I’m going to talk to you about is the language that the CEO’s and CFO’s speak. It’s a specific language that if you start using their vocabulary, they’ll trust you more and they’ll know that you understand what you’re talking about.

Second thing I’m going to do is talk to you about the simple math behind calculating the ROI of your marketing campaigns.

It involves a little bit of math, but if you follow along at the end of this, you’ll be able to do the calculations that will enable you to walk into the CEO and the CFO and say, we spent this and we generated this amount in private and we know that we’re going to make a profit on this campaign because of what I’m about to show you.

If you want to learn how to do that, stick with me.

Now, one last thing I’m going to do at the end of this, I am going to read your mind and know what you’re thinking. I know what you’re thinking — there is no way that dude’s gonna read my mind. But the bottom line is I am going to read your mind, so stick through the program. At the end of it, I’m going to do a simple math problem with you and I’ll show you how I can read your mind.

Okay, let’s do a quick preview before we dive into the math part of the equation.

We’ll learn the language of finance so you can speak more effectively to your CEO and CFO. We’ll learn about lifetime value (LTV), which is the amount of net profit you make during the lifetime a typical customer is with your business.

We’ll also discuss cost per acquisition (CPA). By understanding LTV and CPA. You can calculate whether or not you have a viable campaign. Well, let’s take a look back before we look forward to your ROI.

A typical 20th century marketing campaign involved TV, radio, and print. If you ran a TV, radio or print campaign for say, Coca Cola, it was very difficult to see if the campaign actually resulted in a lift in sales. There were simply too many other variables happening at the same time. For example, sales promotions, weather discounts, competitive intrusions, all of those things added up to other things that could have impacted sales. So it made it difficult for a marketer to go in and say, “Hey guys, our campaign actually drove an increase in incremental profits for the business.”

Well, then digital marketing changed everything. It enabled marketers to target, track and measure like they never had before. Even so only about 25% of all businesses track their marketing expenditure at the ROI level.

Why is that? Because they don’t know the math.

Now, here’s the good news. The math is actually not that complex.

We’re going to dive into it in a second and you’ll see why you can do the math behind your ROI calculation pretty easily.

The starting point for calculating the ROI of a marketing campaign is to understand your lifetime value. Your LTV, in its simplest form, LTV is the amount of profit you generate on a per customer basis over the course of the average customer’s engagement with your business.

In other words, when you get a customer, it’s how much profit you generate from that customer for the average time a customer stays with your business.

We’ll come back to LTV in a moment. In the meantime, let’s review an few important definitions.

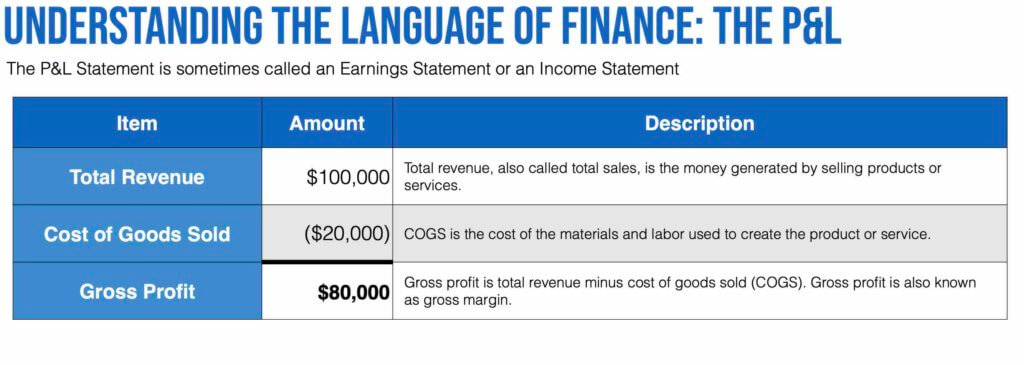

Let’s discuss the language of finance — the P&L. the P&L statement is sometimes called an earning statement or an income statement.

Let’s take a look at it. We’re going to look down one column at a time. Then the amount of that item and then the description. Let’s take a look at this total revenue.

Say you have a small business. Total revenue is $100,000, also called total sales. It’s the money generated by selling products or services.

We all pretty much knew that already. What a lot of us don’t know is that there’s costs of goods sold.

Let’s say you’re making widgets and you generate $100,000 in total revenue. Well, it costs you money to go out and get the plastic for the widgets and all that sort of stuff. In this particular case, it would be $20,000 so cost of goods sold is the cost of the materials and labor used to create the product or service.

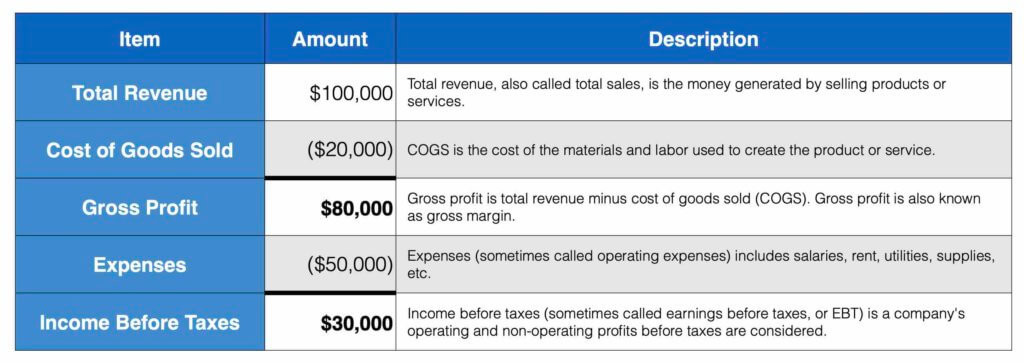

Then we have a gross profit of $80,000. As you can see below, that’s total revenue minus cost of goods sold equals gross profit.

Gross profit is basically a pretty easy calculation — this is the money we kind of brought into our business after we’ve taken out expenses. In this case, we’re taking out $50,000 expenses sometimes called operating expenses include salaries, rent, utilities, supplies, all sorts of stuff like that.

Next, we have income before taxes. This is sometimes called earnings before taxes or EBT. It’s a company’s operating and non-operating profits before taxes are considered.

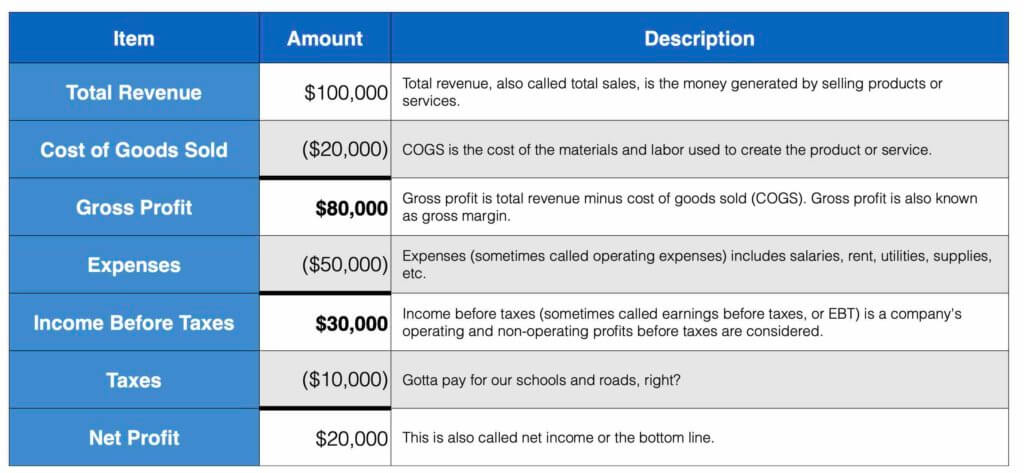

Now in this particular case, that would be $30,000 but we’ve got to give $10,000 of that out to the government to pay for roads and schools and things like that.

That leaves us with a net profit of $20,000. This is called the net income or the bottom line or the net profit. If you generate $100,000 in total revenue, you might end the month or the year with $20,000 in net profit. That’s the money is stuff in your pocket and keep for a rainy day.

Now that we understand the P&L, let’s talk about Lifetime Value.

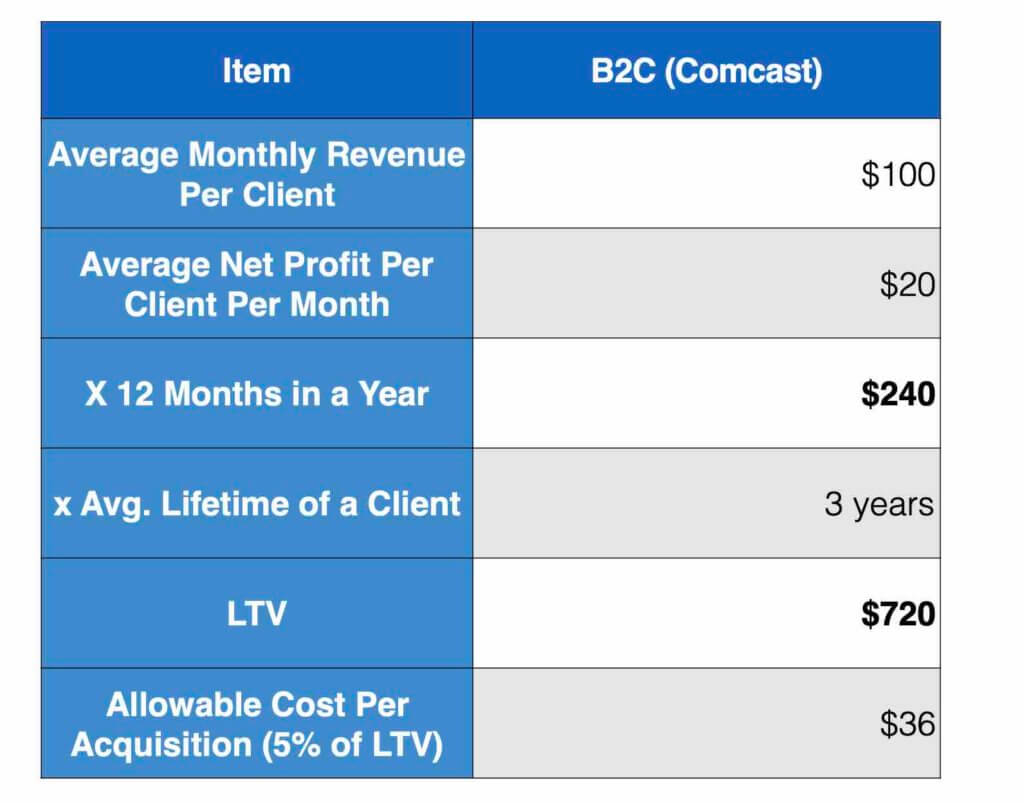

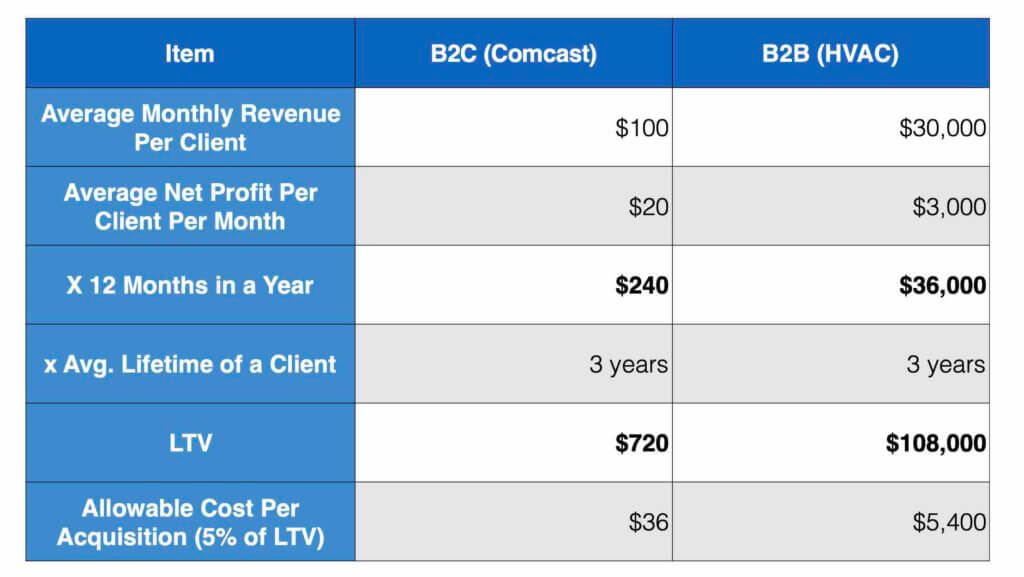

We’re going to look at the item that we’re going to talk about plus an example in the B2C. in this case, we’re looking at Comcast as an example. The average monthly revenue per client. This is the calculation for lifetime value, so we go in and we say, what’s our average monthly revenue per client?

Let’s say it’s 100 bucks. It’s more than that in the real world, but we’re just going with the flow. We’ve got $100 that Comcast generates on a monthly basis per client. The average net profit per client per month is 20 bucks, so that’s the money they make after they’ve paid their costs of goods sold and also their expenses. They keep 20 bucks.

Well, in a year, that means $240 net profit per customer. If you take the average lifetime of a client or a customer that might be three years for Comcast, that means the profit they generate over the course of the time that a customer is typically with them is $720.

There’s also something called an allowable Cost Per Acquisition (CPA).

That’s generally 5% of your lifetime value. That’s $36 in this particular case, that’s how much money you’re allowed to spend in order to generate that $720.

So, if you go into your CFO and say, give me 36 bucks and I’ll earn you $720 over the course of three years in profit, they’re likely to say yes.

Let’s look at this calculation on the B2B side of the equation. On that right-hand column, it’s the same calculation, $30,000 for a B2B HVAC company. That’s when they get a client in the door who’s going to spend 30 grand with them on a monthly basis.

Then the average net profit per client per month for them is $3,000 times 12 months in a year is $36,000 net profit in a given year.

For a B2B big company that’s selling pretty big stuff. The average lifetime of a client is three years. That LTV equals $108,000 and that gives you the allowable cost per acquisition of $5,400. In other words, that’s what you can spend in order to get that client. Now, a typical CPA is sometimes called the cost per sale, but in our case, the cost per acquisition is about 5% of your LTV.

So in the B2B example mentioned previously, the CPA would be about $5,400 which leads us to the next question. How do you calculate the ROI of your campaign?

Well, if your allowable costs per acquisition is $5,400 that means you have to attract leads, then convert them into prospects and then convert the prospects into customers all for $5,400.

It’s not as simple as it looks.

Let’s say you’re running a B2B marketing campaign with organic social, paid social, online display ads, paid search, SEO and email marketing. All of that would add up to what you’re doing for your B2B marketing campaign. You got to pay for that stuff. By the ways, for our purposes, sales brochures, trade show expenses, client entertainment — all of that comes out of the sales budget. So the sales team is paying for brochures and stuff like that based on your campaign.

Okay, from a marketing perspective, you get 10,000 visitors a month who land on your website. All right, that sounds pretty good, but still you got a long way to go before you actually get the calculation. Right?

Out of those 10,000 visits, only 100,000 of those might become leads for your sales force.

Of those 100,000 leads, 10 of them might turn into viable prospects.

Of those 10 prospects, only one of them might become a paying client.

So $5,400 to drive 100,000 visits, resulting in a hundred leads, resulting in 10 prospects, resulting in one client is a viable campaign.

Of course you might do better or worse than the example outline above, but that should give you the math and the logistics behind spending money to drop people into the top of the sales funnel and have move them all the way down to the bottom and become a customer.

Now, here’s what we want you to do before talking to your CFO – recognize that a CFO might do a slightly more complex calculation that do include your annual churn rate, the discount rate and the net present value of money.

Don’t worry about that too much. It’s basically nuances. They’re important nuances to a CFO, but for your purposes, you’re trying to get a general sense of whether or not your campaign is working and we don’t want to get the math too wonky or you’ll spend your day on a spreadsheet.

Also, remember that some campaigns have latent impact on sales. For example, a campaign that had a low click through rate today might generate an in store sale tomorrow, so keep that in mind. For our intents and purposes, we want to simplify all of this to give us a generally acceptable overview of how the finance works.

Now let’s do a quick recap and then we’re going to do a quiz. The terms we discussed early will help you speak the language of your CEO and CFO. Remember the P&L and all the terms we learned there.

LTV is the amount of net profit you make during the lifetime a typical customer is with your business.

CPA can be about 5% of your LTV, but lower is preferred.

And by understanding LTV and CPA, you can calculate whether or not you have a viable campaign.

Okay, it’s time for a quiz. Here’s the quiz. A P&L statement can also be called an earnings statement or an income statement.

Number two: Which statement is correct? If you picked the second bullet point, you are correct in that.

Fill in the blanks on the next one. Your cost per acquisition should be about 5% of your customer lifetime value.

Okay. That’s it for now. Now, let’s talk about the mind reading trick. I know what you’re thinking. The dude’s not going to read my mind. He can’t read my mind. How can you read my mind? He’s talking to me via this computer screen here.

Guess what? I’m about to do it. Watch this.

I want you to pick a number between one and 10. It can be any number between one and 10. You got a number now? Okay, got it. Now multiply that number by nine.

Now you have a new number, right? Take that new number and add the two digits in that number together. Okay?

Now you have another number. Take that number and subtract five from it. Stay with me. Subtract five from that number. Now you have another new number. Take that number and correlate it with a letter in the alphabet, A being one, B being two, C being three.

All right, now you have a letter correlated with the number you picked.

Now, think of a country that begins with that letter. It can be any country.

Think of a country that begins with that letter. Now go to the second letter in that country’s name and think of an animal that begins with that letter, and now think of a color you associate with that animal and … you’re thinking of a gray elephant in Denmark.

Hey, Whoa. How’d that happen? How did I just read your mind?

I’ll tell you what, it’s math. That’s what we talked about today is how to use math in business, and I just showed you how to use math in order to read your mind.

My name is Jamie Turner. I hope you enjoyed what we talked about today. If you liked what you saw, be sure to hit the subscribe button down below and I’ll catch you next time.

About the Author: Jamie Turner is an internationally recognized speaker, author, and CEO who is a recipient of the Socialnomics “Top Keynote Speaker” award (along with Tony Robbins, Ariana Huffington, and Richard Branson). His client list includes The Coca-Cola Company, AT&T, Microsoft, Verizon, SAP, T-Mobile, and Holiday Inn. He is an adjunct professor at both Emory University and the University of Texas and has been profiled in the world’s best-selling advertising textbook. Jamie is the co-author of several essential business books including How to Make Money with Social Media; Go Mobile; and Digital Marketing Growth Hacks. He is the founder of 60SecondMarketer.com and has a new YouTube series called IN:60 which is available on YouTube and was designated as one of 8 “Top Business YouTube Channels” in the nation by Wishpond.com. He is also the co-founder of A School Bell Rings, a non-profit that improves access to education for impoverished children around the globe. If you’d like to find out more about having Jamie speak at your next event, click through to JamieTurner.Live.