Small businesses may need a cash infusion during startup and when they run into cash flow problems. Rapid growth, sudden shifts in the industry or mistakes due to inexperience can all contribute to the need for a small business line of credit.

Two financing options entrepreneurs often turn to are business loans and lines of credit. Each can give you the working funds needed to keep your business afloat. However, they differ in the purpose, repayment plans and structure of the loan.

It’s crucial to understand the ins and outs of each so you can choose the option that matches your business needs. We’ll talk about the features of each and how to choose the right one for you.

Features of Small Business Loans

A small business loan offers a set amount of money at one time. It typically comes from a financial institution such as your local bank or a well-known online lender. The main features of a small business loan include:

- Fixed payments during a set amount of time

- Lower interest than credit cards

If your business has extensive financial needs, such as needing to purchase equipment to scale up or marketing to launch a new product, a small business loan is probably right for you. Small business loans can be secured or unsecured. A secured loan puts your personal or business assets on the line. Credit score and earning potential determine how much you can get for an unsecured loan.

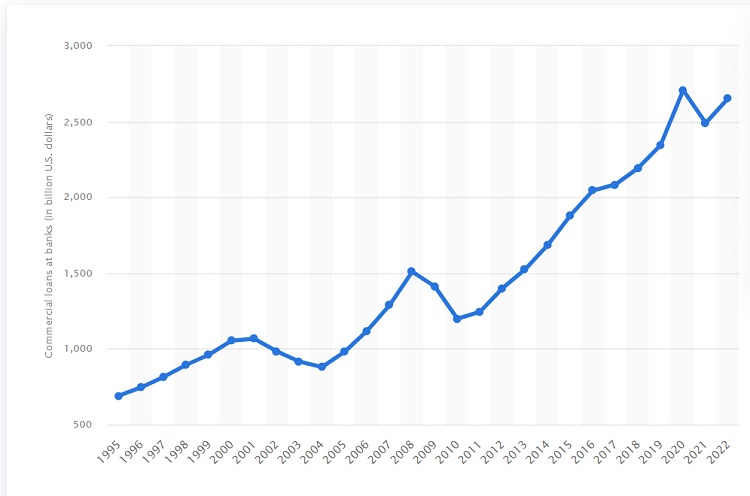

According to the chart above, banks gave out $2.6 billion in various commercial loans in 2022. While the number goes up and down from one year to the next, it’s clear that businesses are borrowing frequently.

An example of a secured loan might be a $20,000 business loan for expanding a coffee shop. The business owns the building the original shop is in and puts it up as collateral as a promise to pay back the money borrowed. You’ll typically get a lower interest rate and longer time to repay because there is less risk to the bank.

An example of an unsecured loan is a $6,000 loan to start up a new coffee shop. You do not yet own a building or equipment so you have nothing to offer as collateral outside of personal assets. Interest rates tend to be higher and repayment times shorter.

Benefits of Secured Loans

Although you’ll put property, inventory or equipment on the line that the bank can sell if you default on the loan, you’ll gain:

- Lower interest rates

- Longer repayment terms

- Reduced risk

- Regular payments for easier budgeting

- Ability to build business credit

Look for a bank that strives to meet the needs of its customers. A solution should be tailored to your financial profile and growth rate.

Benefits of Unsecured Loans

If you don’t qualify for a secured loan, there are still advantages to taking out an unsecured one:

- Do not require collateral

- Shorter payment times mean you’re out of debt faster

- Approval is usually faster

- No risk to your personal assets

Source: https://www.nerdwallet.com/article/small-business/sba-loan-rates

Don’t rule out the lower and sometimes more frequently approved small business loans from places with the U.S. Small Business Administration (SBA). For loans under $25,000, 12.5% of businesses paid them off in less than seven years. The attractive repayment structure makes these loans attractive to entrepreneurs.

Features of a Line of Credit

A small business line of credit is another financing option for business owners, but it varies in distinct ways from a traditional loan. If your company needs access to funds at times but not at others, the flexibility of a line of credit may be just what you need to get through the ups and downs of entrepreneurship.

With this type of financing, you’re approved up to a set amount. You can pull some or all of the amount out at any time, repay it and borrow again. It works somewhat similar to a credit card, but you’ll pull cash instead of putting purchases on the account.

Some of the reasons a business might need a small business line of credit include:

- Fluctuations in cash flow

- Working capital needs

- Help scaling up or during spurts of growth

- Funding during lean times

One of the most significant benefits is the ability to borrow what you need without going over or owing more than necessary. You might use a line of credit to manage your day-to-day costs, such as ordering inventory for the busy holiday season or paying for an emergency repair.

As with loans, lines of credit might be secured or unsecured. Different lenders require different credit scores and collateral. It isn’t surprising that secured lines of credit typically have lower interest rates and unsecured higher ones.

Each time you pay on the borrowed amount, your available funds increase. You can borrow again if needed without having to take out additional funding or apply at your bank. Since it is always there and ready to access, a line of credit is great for managing cash flow episodes or following up on a rare opportunity to scale up.

For example, if you sell a product and a big box retailer suddenly wants an order of 1,000 units, can you fill the order and take the opportunity? A line of credit might be just what you need to up your production and get your brand in stores.

What Do Lenders Require for Financing?

Forbes recently reported that most lenders want to see a personal credit score of 680 or above. While the numbers can vary, strive for the highest score possible to gain the highest range of credit for the lowest interest rate.

Other requirements might include:

- Established business for a year or two

- Strong credit history

- Clear business revenue

- Business plan for how the funds might be used

Source: https://www.statista.com/statistics/754738/small-businesses-loan-approval-rates-usa

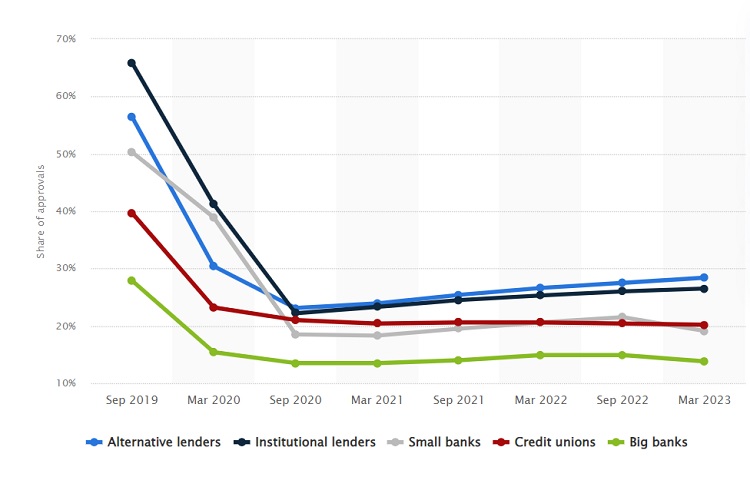

What happens if you don’t get approved for a loan from your local bank? Don’t rule out other options. The chart above shows big banks cover around 14% of all business loans, while alternative lenders make up almost 30%.

How Can I Get a Better Rate?

When borrowing money, saving even a few percentage points can make a significant difference in the payments and the interest owed. When your monthly installments are lower, you can throw more toward the principle. Extra money on the base of the loan pays it off faster.

Since personal credit is typically considered for small business loans, you’ll want to improve your credit rating. Ways to do this include:

- Paying off smaller debts to reduce financial burdens

- Increasing income

- Making payments on time

- Contacting credit reporting agencies to fix any errors

- Making small purchases and pay them off immediately

- Paying off loans early

- Making weekly payments on accounts and decreasing debt-to-income ratio

Download an app or utilize a third-party website that helps you improve your credit score, such as Credit Karma or Experian Boost. Be cautious of scams or places just trying to get your sensitive data.

Fixing a lower credit score can take time and effort. Make small changes and wait until your numbers increase.

Which Option Is Right For You?

Knowing which type of financing is best for your company depends on your goals and financial history. For some small businesses, it makes the most sense to have both a revolving line of credit and a small business loan. Think about your organization’s current and future money needs.

What one-time, large-sum money needs do you have in the next six months to a year? What is the purpose of the funds you plan to apply for? Do you need to expand in the near future to continue growth?

Rule out other options such as investors and government grants. You don’t have to repay grant money, giving you working capital for specific projects without tapping into your profits.

Once you have an idea of your company’s needs and a firm grasp of which type of loan might work best, talk to your financial advisor and local bank manager about what options are available based on your credit history, collateral and your business track record.

About the Author: Eleanor Hecks is editor-in-chief at Designerly Magazine. She was the creative director at a digital marketing agency before becoming a full-time freelance designer. Eleanor lives in Philadelphia with her husband and pup, Bear.